DGAP-News: Savills Immobilienberatungs-GmbH / Key word(s): Real Estate/Research UpdateSavills Immobilienberatungs-GmbH: Top 6 office letting markets in Germany 2021 06.01.2022 / 12:45 The content of the announcement is the issuer / publisher responsible.

Top 6 office rental markets 2021

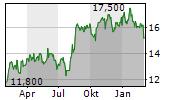

Higher rents due to users' increasing space and location requirements

Even in the final quarter of 2021, the top 6 office markets continued on their recovery course. The take-up of space in the last three months alone totaled around 1 million m², so that an annual turnover of almost 3 million m² was achieved. That is a fifth more than in 2020, but at the same time about a fifth less than the level of the years before the COVID-19 pandemic. The vacancy rate rose by around a quarter of a million square meters in the fourth quarter of 2021, and the vacancy rate reached 4.3%. Despite the higher vacancy rate, rents rose for the most part - by a good 3% compared to the previous quarter to EUR 36.70/m².

"All in all, the German office markets came through the first two years of the pandemic extremely well. Take-up of space is still below average in a long-term comparison, but in view of the increasing demand dynamics we expect a further increase for the current year. The increasing preference of users for high-quality space combined with rising vacancies means that owners are under greater pressure to renovate and modernize," concludes Jan-Niklas Rotberg, Head of Office Agency Germany at Savills.

Large occupiers still cautious - further increase in vacancies foreseeable

It is still primarily the large users, such as international corporations, who are acting more cautiously than before the pandemic. One expression of this: in all markets except Cologne, the average size of the office space rented last year was smaller than in previous years. "In view of the sharp increase in the number of infections at the end of the year, many employees switched back to working from home as their first place of work, especially in larger companies. As a result, there is still great uncertainty there as to where the home office quota will level off post-pandemic and how high the space requirement will be," commented Matthias Pink, Head of Research Germany at Savills. The postponement of rental decisions by some large users also means that some project developments that will be completed this year or next do not yet have an anchor tenant. More than 2 million m² of new office space is expected to come onto the market in both years - twice the average of the ten previous years. More than 2.5 million m² are not yet rented in these projects (approx. 1.1 million m² in 2022, 1.6 million m² in 2023) and consequently Savills expects a further increase in vacancies, at least for the current year.

Increasing quality and flexibility requirements - an opportunity for flexible workspaces?

The rising vacancy rate will, however, materialize less in new buildings than in older, non-modernized existing properties. "We have noticed that companies have a significantly increased preference for high-quality office space. In the case of large-scale users, this is often the same as newly built or completely refurbished space, because this is the only place where ESG compliance can be ensured or it is easiest to prove it in new buildings - and beyond that such areas generally offer better quality than stocks in comparable locations," says Rotberg. A measurable indication of the greater preference of office users for modern space in good locations is the sharp rise in median rents*. Within a year, it increased by almost 6% and thus significantly more than the prime rent in the same period (+ 2%). "In addition to the increasing demands for space and location quality, the flexibility requirements are also increasing. This applies to both the design of the space and the contract design. The desire for partial and special termination rights and generally as flexible terms as possible is more present among users. The owners want the reverse and owners have the greatest possible long-term planning security, not least because of the sharp rise in construction and expansion costs. Providers of flexible workspaces can be part of the solution here that brings these conflicting needs together," reports Rotberg. You can also find all the data and facts in our current Market in Minutes Top -6 Office Markets Germany on our website at www.savills.de/research.

*The median rent is the average rent of all rental transactions. This means that 50% of all lettings are above and 50% below the median rent. The size of the space rented in each case is irrelevant when calculating the median rent.

About SavillsSavills is one of the leading global real estate services companies, headquartered and listed in London. Founded in 1855, the company has a long history of tremendous growth. Savills sets trends instead of following them and today has more than 600 offices and partners in the Americas, Europe, Africa, Asia Pacific and the Middle East with over 39,000 employees.

In Germany, Savills has more than 300 employees in seven offices in the most important real estate locations. Today, Savills offers its customers expertise and market transparency in the following areas:

- Investment

- Agency

- Portfolio Investment & M&A Advisory

- Valuation

- Landlord Services

- Occupier Services

- Workplace Consulting

- Property management

- Facilities Management

- Research

A unique combination of industry knowledge and entrepreneurial thinking and action offers our customers access to real estate knowledge of the highest quality. Our employees, their creativity and their willingness to perform are our real capital - they are valued both for their innovative approaches and for their strong negotiating skills. Savills has specialized in a select group of customers and offers these companies and individuals a highly professional service in order to achieve common goals. Savills is synonymous with a premium brand and a high-quality service offering that looks at properties individually and invests in strategic relationships.

01/06/2022 Release of a corporate news/financial news, transmitted by DGAP - a service of EQS Group AG.The issuer / publisher is responsible for the content of the announcement.The DGAP distribution services include statutory reporting requirements, corporate news/financial news and press releases. Media archive at http://www.dgap.de